child tax credit payment for december 2021

The timeframe for receiving advance payments of the Child Tax Credit CTC during 2021 has expired. Specifically the Child Tax Credit was revised in the following ways for 2021.

Child Tax Credit Advanced Payments Information Bc T

By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes.

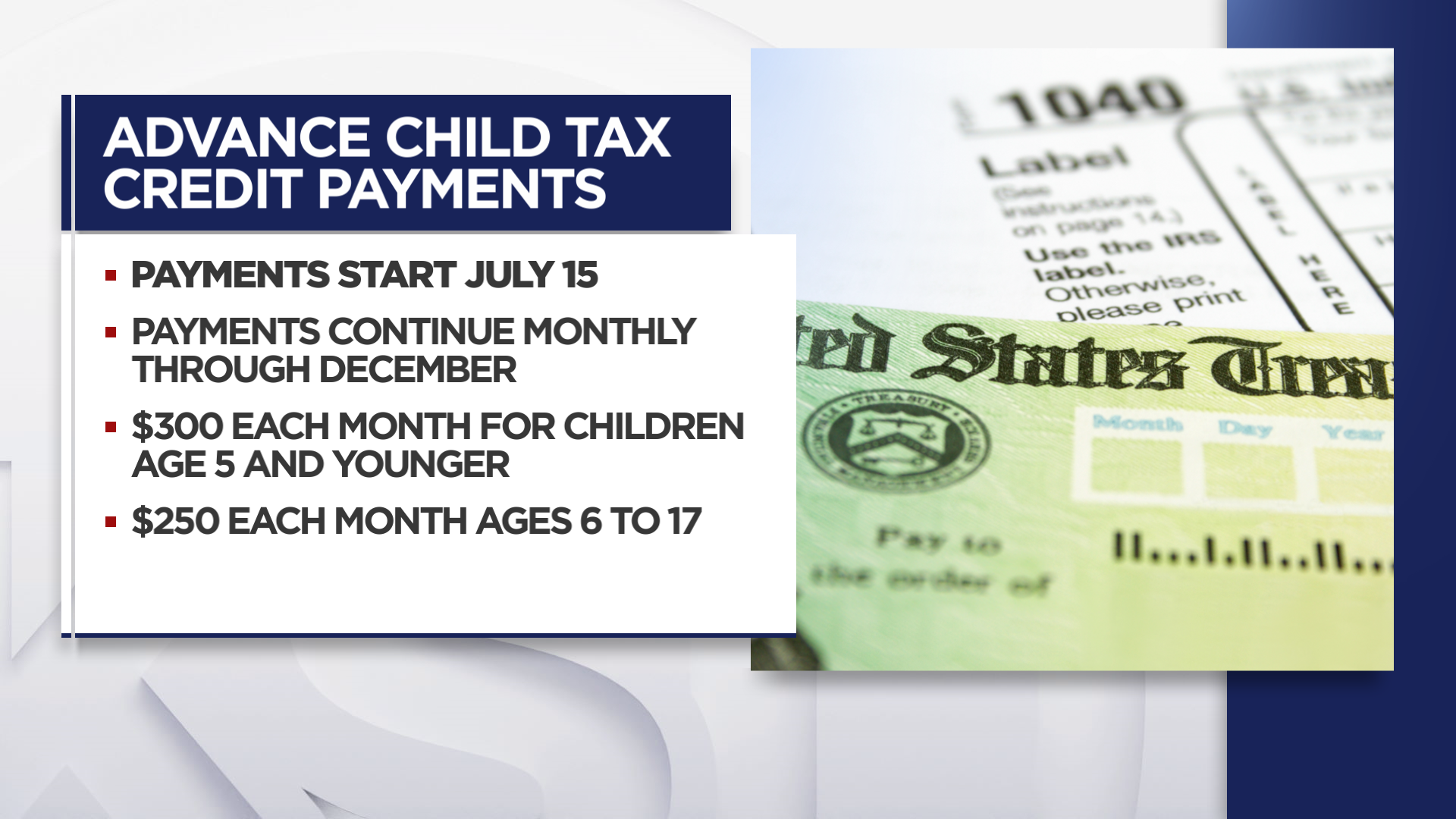

. Eligible families who did not. 2021 child tax credit maximum payments Age 5 and younger Up to 3600 with half as 300 advance monthly payments. The Child Tax Credit provides money to support American families.

The credit amount for eligible dependent children is 3000 per child between the ages of 6 and 17 and 3600 per child for children under age 6. The credit amount was increased for 2021. Claim the full Child Tax Credit on the 2021 tax return.

If you preferred not to receive monthly advance Child Tax Credit payments because you would rather claim the full credit when you file your 2021 tax return or you knew. For families with qualifying children who did not turn 18 before the start of this year the 2021 Child Tax Credit is. Families that did not receive monthly payments can still claim the full amount of the Child Tax Credit they are eligible for when they file taxes.

How to track your payment. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Here is some important information to understand about this years Child Tax Credit.

At first glance the steps to request a payment trace can look daunting. This means that the total advance payment amount will be made in one December payment. Most families are eligible to receive the credit for their children.

The most recent payment was supposed to arrive by direct deposit on December 15. As part of the federal governments pandemic response the 2021 expansion of the Child Tax Credit increased the amount of the credit made more families eligible for the tax. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month.

Since July the Child Tax Credit previously a once-a-year credit has been sent out in the form of a direct payment worth up to 300 per month for eligible families. The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child. The Child Tax Credit reached 612 million children in December 2021 an increase of 2 million children over six months from the rollout to 593 million children in July.

Advance Child Tax Credit Payments in 2021 Under the American Rescue Plan Act of 2021 we sent advance Child Tax Credit payments of up to half the 2021 Child Tax Credit to. Youll need to print and mail the completed Form. Check mailed to a foreign address.

Families that received the first half in 2021. 3600 for children ages 5 and under at the end of 2021. And 3000 for children ages 6.

The Child Tax Credit Update Portal and Child Tax Credit Non-filer Sign. Child Tax Credit - December 2021. The American Rescue Plan increased the amount of the Child Tax.

Why have monthly Child Tax Credit payments. The amount of credit you receive is based on your income and the.

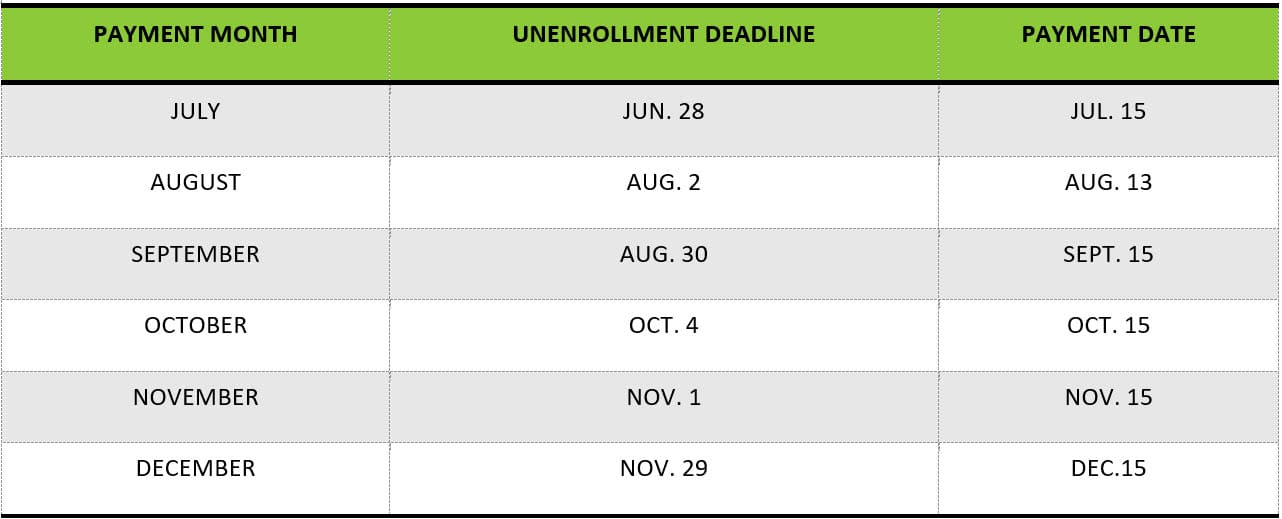

Last Day To Unenroll In July Advanced Child Tax Credit Payment

One Remaining Child Tax Credit Payment For 2021 Make Sure You Re Enrolled For 2022 Wkrc

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

White House Says Could Pay Double Monthly Child Tax Credit Payments In February

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

Members 1st Federal Credit Union Eligible Families Have Begun Receiving Monthly Child Tax Credit Payments And They Will Continue To Be Issued Through December 2021 View The Irs Payment Schedule

The 2021 Child Tax Credit Information About Payments Eligibility

Liberty Tax Here S A Breakdown Of What To Expect With The 2021 Child Tax Credit Payment Schedule Sidenote If You Have A Baby In 2021 Your Newborn Will Count Toward The

Enhancing Child Tax Credits Support Of New Jersey S Neediest Families New Jersey State Policy Lab

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

What Is The Child Tax Credit Tax Policy Center

Advance Child Tax Credit Payments Hit Bank Accounts Ksnv

2021 Child Tax Credit Payments Irs Notice Youtube

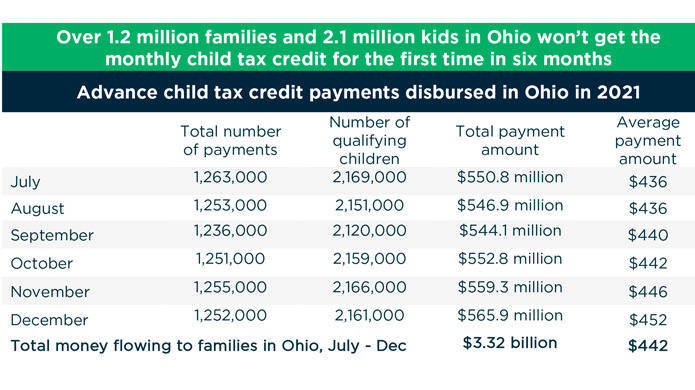

What S At Stake For Families As The Monthly Child Tax Credit Payment Ends Ohio Capital Journal

Millions Of Families Will Receive A Child Tax Credit Monthly Payment Next Week It Could Be The Last One Cbs News